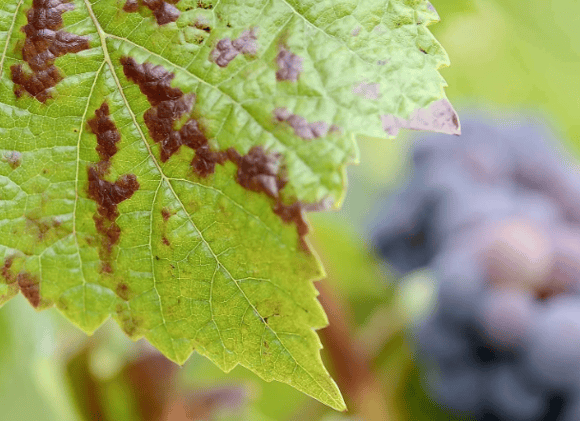

Red blotch a worldwide vineyard threat // Wine Diplomacy Paves the Way

March 2, 2026 - Wine Industry Insight Daily News Feed

Bank of America Report: Alcohol Sales at Bars Trend Upward, While At-Home Drinking Slides // Will 2026 be another tough year for grape powdery mildew?

February 27, 2026 - Wine Industry Insight Daily News Feed

Daniel Duckhorn, Napa Valley Merlot’s greatest champion, dies at 87 // Governor Newsom launches most ambitious water plan in California history

February 26, 2026 - Wine Industry Insight Daily News Feed

Jackson Family Wines closes major winery, confirms layoffs // New Lawsuit Aims to Increase Out-of-State Wineries’ Access to California Retail Market

February 25, 2026 - Wine Industry Insight Daily News Feed

U.S. Wine Exports Plummeted by $428 Million in 2025 // New Research Project Launches to Better Understand Buyers of High-End Napa Valley Wines

February 24, 2026 - Wine Industry Insight Daily News Feed